Mobile payment has become the most important feature that cannot be ignored, with the increasing rise in smartphone usage for restaurants, shopping, and ordering food, mobile payment spending has spiked.

Nowadays, businesses must integrate payment gateways into their apps to drive user engagement and satisfaction. Because the demand for secure, swift, and adaptable payment solutions within mobile apps has increased.

Considering the digital landscape of the global industry, there are multiple countries making progress in business innovation, and Austin is one of them.

So, if you’re looking to incorporate payment gateways into your business app, now is the right time to hire a trusted mobile app development company in Austin. They are experts in creating seamless, secure, and user-centric payment methods that can significantly enhance your app’s engagement.

Let’s take a closer look at the importance of integrating payment gateways in mobile apps and how to choose the right payment way for your business app.

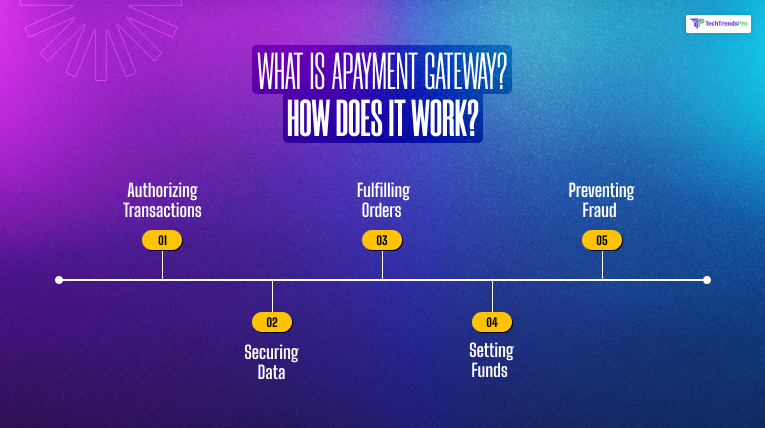

What Is A Payment Gateway? How Does It Work?

A payment gateway is basically a service that helps you with processing online transactions for your business.

If you have an online business, whenever someone places an order on your website, then with the help of a payment gateway, verify the details and determine if you have enough funds to complete the transaction or not.

This is a much better and sophisticated encryption process to make sure that the customer’s personal details are safe and secure.

If it comes to how this payment gateway works, then here it is:

· Authorizing Transactions

With this payment gateway, you can complete a transaction when customers are coming and making a purchase on your website, and submitting their card details.

The software then communicates with the bank to check the availability of funds in the account before transaction authorization.

· Securing Data

Ensuring data security is the number one priority of payment gateways. This software uses advanced technologies such as encryption and tokenization to provide a safeguard for data sensitivity during transactions between companies, clients, and banks.

· Fulfilling Orders

The payment gateway also notifies the company by dropping a message after the payment is successfully authorized. This signal signifies that the business to move ahead with the order fulfillment.

· Setting Funds

Now that the transaction is completed, the gateway facilitates the fund transfer process from the client’s bank account to your business account. Throughout this process, the funds are being collected, deposited, and the final settlement is made.

· Preventing Fraud

These gateways use methods like geolocation and IP monitoring to identify any and all suspicious activities in order to protect the company and its clients.

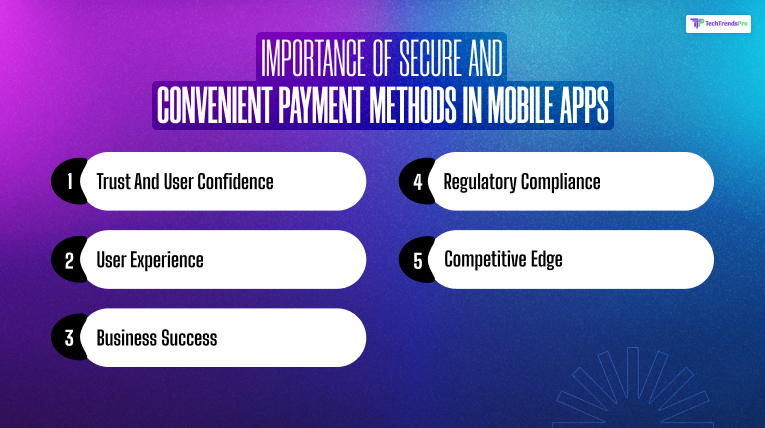

Importance Of Secure And Convenient Payment Methods In Mobile Apps

Secure and convenient payment methods play an important role in the success of business apps. So, here’s a closer look at their critical importance:

Trust And User Confidence

- Security Assurance: Secure payment methods ensure encrypted transactions, protecting sensitive data from potential breaches. So that Users can trust that their financial credentials are safe.

- Fraud Prevention: Secure payment gateways often come with robust fraud detection measures, reducing the risk of fraudulent transactions and increasing user confidence.

- Credibility: Apps that prioritize secure payments convey reliability and professionalism, encouraging users to transact without hesitation.

User Experience

- Efficiency and Speed: Convenient payment methods streamline the checkout process, making transactions quick and hassle-free. This boosts the overall user experience, reducing abandonment rates.

- Multiple Options: Offering diverse payment methods caters to a broader audience, accommodating users’ preferred choices and increasing the likelihood of completing a purchase.

Business Success

- Increased Conversions: Keep in mind that smooth payment experiences lead to higher conversion rates. However, simplifying the payment process encourages users to make purchases, benefiting the app’s revenue stream.

- Repeat Business: Satisfied users are more likely to return, and a positive payment experience contributes to customer loyalty, prompting return visits and developing long-term engagement.

- Reduces Cart Abandonment: One of the primary reasons for abandoned carts during the checkout process is the complexity or inconvenience associated with payment procedures.

By incorporating seamless payment gateways directly into the mobile app, businesses ease this issue by offering users a hassle-free payment experience.

Regulatory Compliance

- Adherence to Standards: Utilizing secure payment methods ensures compliance with industry standards and regulations, safeguarding both the app and its users from legal complications.

Competitive Edge

- Market Differentiation: Apps offering secure and convenient payment methods stand out in a crowded market. This can serve as a competitive advantage, attracting users who prioritize safety and ease of transactions.

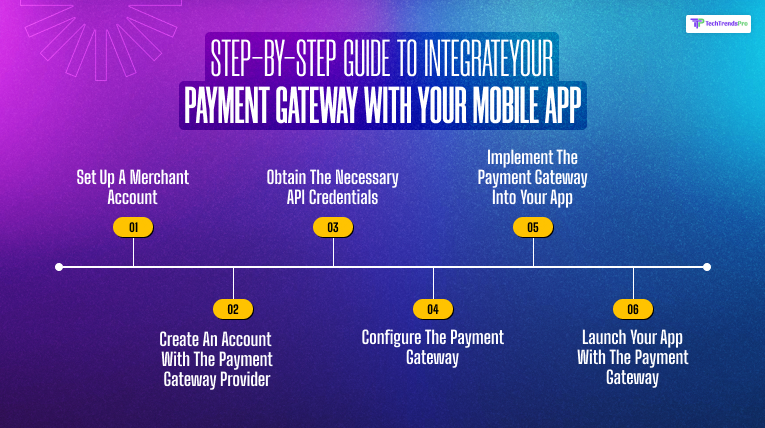

Step-By-Step Guide To Integrate Your Payment Gateway With Your Mobile App

If you are ready to incorporate the payment gateways in your business app, then you should consider partnering with a top-tier mobile app development company in Toronto, Florida, and the UK.

Their proficiency in integrating payment gateways seamlessly provides a user-friendly payment experience for your customers.

So, here’s a step-by-step guide to integrate the right payment gateway with your mobile app:

Step 1: Set up a Merchant Account

A merchant account is needed through the payment processor, since the organization processes the credit/debit card transactions.

The payment processor ideally should be from the same company as the payment gateway provider. This way, you can manage everything with one central system.

Step 2: Create an account with the payment gateway provider

Even though the payment processor and the gateway payment are the same thing (like if you were working with Stax), the service is within the broader solution spectrum, so it needs its own setup.

Step 3: Obtain the Necessary API credentials

API full form is “Application Programming Interface”. The API payment gateway shows how the payment gateway is going to communicate with the app you are using for transaction processing.

To start, the API credentials need to be generated from the payment gateway provider. This requires making a test account to avoid processing any payment during the testing and development phase.

Step 4: Configure the Payment Gateway

The next step is configuring the payment gateway, which includes specifying the types of payments that you wanna accept, like credit or debit cards, and also setting up other options like fraud prevention tools and recurring billing.

Step 5: Implement the Payment Gateway into your App

Finally, you are ready to start coding. The gateway is going to provide you with the necessary code snippets along with documentation to get you started.

The code needs to be integrated into your app and the process of sending the transaction data to the gateway, at the same time getting back the confirmation.

For both Android and iOS apps, the setup process of integrating the payment gateway is basically the same. Although the programming languages will differ.

a. Start accepting cards by using the Drop-in UI

The drop-in UI is just a few code lines to be embedded into the app’s code. The code will be provided to you through the payment gateway provider.

b. Generate a client token with your server

A client token is nothing but a secure form of identifier to use the initialization process of the Drop-in UI. The token gets generated on your server and then passed to the app. With every new app launch, generating a new client token is important.

c. Test your integration

Once everything is done, the integration is completed, it is important to test it out to make sure everything is working as it should be.

Step 6: Launch your app with the payment gateway

Now that the integration and testing phases are completed and you are satisfied with the overall outcome, you are ready to launch the payment gateway integration app. But you have to keep a few things in mind.

- The steps that I have explained here may vary depending on the type of payment gateway you are choosing.

- It is important to inform and consult your development team or the company before you choose the type of processor or payment gateway, since they are the ones who will integrate it into the app.

- It is important that you test out the integration properly before you launch the app, so that there are no issues with the payment process.

Top 5 Mobile App Payment Gateway Providers

You already know by now the major criteria for selecting the best payment gateway for your app. But to give you a full overview, here are the most popular online payment providers.

| Payment Gateway | Countries | Currencies | Types of Payments | Fees |

| Exactly | Global Coverage | 150+ | Debit/credit cards Digital wallets | Personalised fees |

| Zooz | Global Coverage | 100+ | Credit/debit cards, E-WalletsWire/Bank transfers, ACH | Customized plans |

| Dwolla | United States | 40+ | ACH payments | 0.5% per transaction |

| SecurePay | Australia | 30+ | Bank cardsE-cardsApple Pay | 1.75% + $0.30 |

| Authorize.Net | 16+ | 13 | Credit/debit cardsBank redirectsBank transfers | 2.9% |

| Amazon Pay | 18+ | 12 | Bank cards Online payment systems | 3.5% |

| Stripe | 25+ | 135+ | Credit/Debit cardsBank redirects Bank transfers | 2.9% |

| PayPal | 200+ | 100+ | Credit/Debit cardsE-wallets | 2.9% |

| Braintree | 10 | 130 | Credit cardsDigital wallets Bank transfers | 2.9% |

| EWAY | 6 | 100+ | Credit /debit cardsE-wallets | 1.9% |

Wrapping Up!

Integrating the mobile payment gateway into your business app is an important decision for your business that directly impacts your app’s success.

However, businesses need to prioritize user convenience by selecting payment gateways that support preferred payment methods to facilitate seamless online transactions.

Read Also: