The term “FintechZoom.com FTSE 100” has been utilized to signify that FintechZoom’s report and analysis of the FTSE 100 index are very important stock market indices worldwide.

FintechZoom.com and FTSE 100 are sources of finance offering real-time updates, sharing news, and financial trends, including investment comments.

Utilized with the FTSE 100, it provides a useful tool for tracking UK market performance.

The FTSE 100 Index, or Financial Times Stock Exchange 100 Index, is a gauge of the top 100 companies listed on the London Stock Exchange (LSE) based on market capitalization. They are the giant energy, finance, health, and consumer goods industries.

Why Does The FTSE 100 Matter?

FTSE 100 is essentially a barometer of the UK economy, even though most companies it lists are multinational global giants. It affects:

- Investor mood: Increasing FTSE = positive mood in the economy.

- World markets: Overseas investors keep it under close watch.

- Pension funds and savings: Pension portfolios are either backed by FTSE companies or not. This assists institutional investors and individuals in making informed financial decisions.

How Does FintechZoom Help?

FintechZoom gives live updates, expert views, money predictions, and easy-to-understand FTSE 100 charts. Its service gives the benefit of:

- Following day-to-day changes in the FTSE 100

- Making sense of why prices are rising or falling

- Hearing earnings reports and signals from the market

- Receiving professional investment advice. As a teen investor or financial planner, FintechZoom makes complicated market data accessible as smart advice and knowledge.

How’s The FTSE 100 Today?

Note: Current numbers are typically posted on FintechZoom.com or financial news websites.

Up to and including the latest reports on the market:

- The FTSE 100 has shown small rises, and interest in interest rate news and UK and US inflation rates has been minimal.

- Short-term trends can be influenced by performance drivers such as top players BP, Shell, HSBC, and Unilever.

- Economic factors such as GDP growth, consumer confidence, and inflation data can influence short-term trends. To see the latest figures, visit FintechZoom.com’s FTSE 100 page for live news and charts. The following is a news digest with the latest information:

Why Should Teens Be Interested In The FTSE 100?

There are multiple reasons why teens and Gen Z should be interested in the FTSE 100, so here are the reasons.

1. Financial Literacy Earlier

Learning about the FTSE 100 teaches teens about:

- Investing

- Economic trends

- Financial planning

2. Room for Passive Income

Some of the FTSE 100 companies offer dividends, where teenagers can begin earning money passively.

3. Career Awareness

These are world employers—knowing how they do it is helpful for career decisions.

4. World Mindset

Global indices are interpreted to learn a global mindset—a helpful skill for the modern economy.

Reading FTSE 100 Charts At FintechZoom

FintechZoom provides interactive FTSE 100 charts with:

- Line graphs demonstrating daily/weekly/monthly movement

- Volume indicators to monitor the volume of stock traded

- Trendlines and moving averages to identify patterns

- Candlestick opinions for professionals

Key Tips:

- Green = rising price, Red = falling price

- Bear in mind 1-month and 6-month trends as context

- Utilization of indicators such as RSI and MACD to make a forecast of movement

How Frequently Do Changes Happen In The FTSE 100?

The FTSE 100 is revised each quarter, usually in:

- March

- June

- September

- December

Companies are added or removed according to market capitalization, keeping the index current and reflecting current market trends.

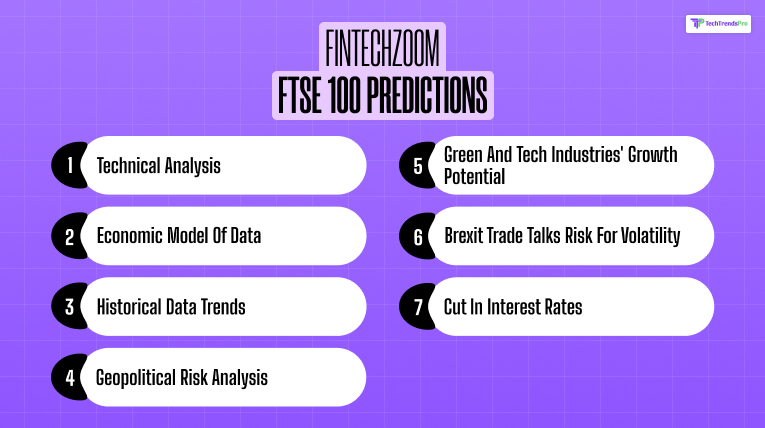

FintechZoom FTSE 100 predictions

While no one can assure performance in the future, FintechZoom experts use the following tools:

- Technical analysis

- Economic model of data

- Historical data trends

- Geopolitical risk analysis.

- Green and tech industries’ growth potential

- Brexit trade talks risk for volatility

- Hopeful caution with a cut in interest rates

FintechZoom New Investor Tips

Here are a few tips for new investors that they might find helpful, so take a look at them.

- Begin Small – Invest only that which you can afford to lose.

- Diversify – Avoid putting all your eggs in one basket or index.

- Research – Utilize FintechZoom to read analyst opinions and company reports.

- Observe Market Trends – Be attuned to more than price action alone.

- Be Consistent – Periodic investing is more likely to outperform attempting to “time the market.”

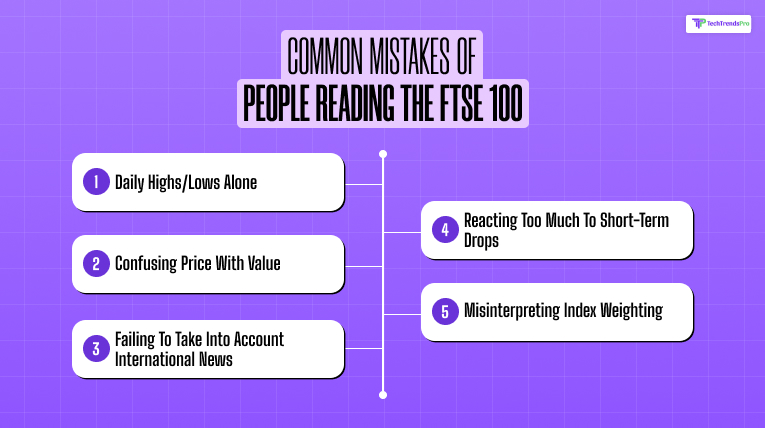

Common Mistakes Of People Reading The FTSE 100

While reading the FTSE 100, it is quite possible that people might face certain difficulties reading it, so here are a few common mistakes that people might make while reading the FTSE 100.

- Daily highs/lows alone on their own

- Confusing price with value (a cheap stock is not always a good stock)

- Failing to take into account international news, which influences multinational FTSE companies

- Reacting too much to short-term drops

- Misinterpreting index weighting – certain companies are more weighted than others.

Is The FTSE 100 Just For The Wealthy?

No. Using tools like:

- FintechZoom

- eToro

- Trading 212

- Hargreaves Lansdown. You can begin to invest as little as £10–£100. Fractional shares and ETFs enable FTSE 100 investment for all.

Does The FTSE 100 Represent The True Economy?

Yes and no.

Yes: It indicates large company performance and foreign revenues.

No: It does not indicate small businesses, local economies, or pay rises.

Nonetheless, it’s a useful indicator for overall economic sentiment and investor mood.

How To Stay Up To Date Every Day

If you are planning on investing, then you need to stay updated every day, but how are you gonna do that/

Here are a few ways by which you can achieve that.

- Bookmark FintechZoom.com/FTSE-100

- Subscribe to email newsletters

- Mobile apps such as Investing.com or Bloomberg

- FTSE-related hashtags on Twitter/X.

- Create Google Alerts for “FTSE 100 news”

Top 5 Best Days In FTSE 100 History

When it comes to the FTSE 100, there are 5 best days in history that stand out, here are the days.

- March 24, 2020 – +9.05% following huge stimulus announcements

- November 9, 2020 – Hopes for Pfizer vaccine

- April 6, 2009 – Rebound from 2008 crisis lows

- October 13, 2008 – Central bank intervention rally

- March 17, 2003 – Markets recover from Iraq War tensions

Top 5 Worst Days In FTSE 100 History

When there are best days, there are worst days as well, so here are the top 5 worst days in the history of the FTSE 100.

- October 20, 1987 (Black Monday) -11%

- March 12, 2020 – COVID panic sell-off

- September 11, 2001 – Shockwaves in the wake of the terror attack

- June 24, 2016 – Fallout from Brexit referendum

- October 10, 2008 – Global financial crisis deepens

What Moves The FTSE 100 The Most?

When it comes to the FTSE 100, these are the top 5 moves that work the best out of all others.

- Monetary policy (interest rate rises/falls by the Bank of England)

- Geopolitical risk (wars, sanctions, Brexit)

- World commodity prices (particularly oil and metals)

- FTSE 100 giants’ profit statements

- Exchange rate fluctuations (GBP/USD/EUR)

Why The FintechZoom FTSE 100 Combo Is A Power Tool For Investors

While the FTSE 100 is an index of stocks, it’s significantly more than that—it’s a window into the global financial system, at least from a UK perspective.

FintechZoom.com enhances that view even further, with its users benefiting from real-time data, simple analysis, and valuable forecasts made available to novices and experts alike.

To students, instructors, new investors, and financial professionals, being updated with FintechZoom’s FTSE 100 reports gives a person a good basis for more informed financial choices.

Additional Resources: