Planning for retirement is not as simple anymore. Financial insecurity, inflation, and varying returns in the market have made even most of us look for safe and diversified investments to sustain themselves for the next few years.

A better option, more in demand today, is a Precious Metals IRA (Individual Retirement Account). Are you?

This entire question-and-answer guide gives you everything you need to know about Precious Metals IRAs—what they are, how they work, their advantages and disadvantages, how to convert IRA to Gold, and why you must invest in one in your portfolio.

What Is A Precious Metals IRA?

A Precious Metals IRA is a self-directed individual retirement account where you invest in physical gold, silver, platinum, and palladium rather than stocks and bonds.

Whereas with a regular IRA, you keep paper, with a Precious Metals IRA, you hold actual, IRS-approved metals at a secure storage facility.

Precious Metals Eligible:

- Gold: Must be 99.5% or better (i.e., American Gold Eagle)

- Silver: Must be 99.9% fine (i.e., Silver Canadian Maple Leaf)

- Platinum and Palladium: Must be 99.95% pure

They’re held in IRS-approved vaults—you don’t have them in your home.

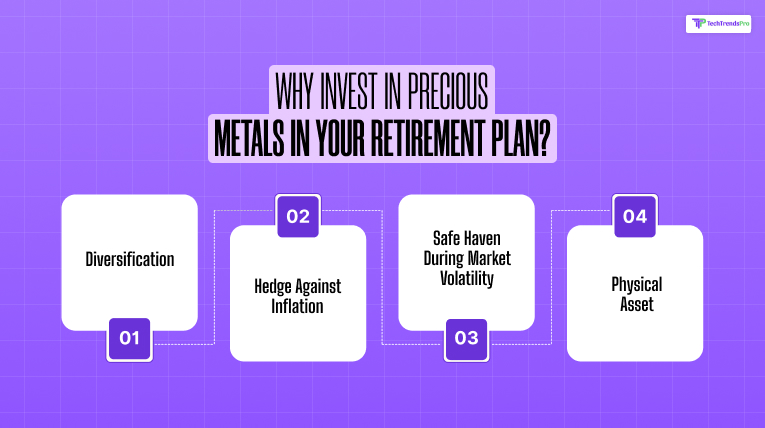

Why Invest In Precious Metals In Your Retirement Plan?

Let’s discuss why more retirement planners and financial planners are suggesting this strategy:

1. Diversification

Diversifying your retirement portfolio lowers the risk. Stocks and bonds may fluctuate, but precious metals appear to move independently outside of the herd markets. Gold prices rise when there is a stock market crash.

2. Hedge Against Inflation

Gold and precious metals are always a store of value and a good hedge against currency devaluation. Multi-decade history of inflation, and people are flocking to metals to preserve purchasing power.

3. Safe Haven During Market Volatility

When there is geopolitical instability, market volatility, or worldwide pandemics, precious metals are “safe haven” assets.

4. Physical Asset

Money in the brokerage account can be stolen, defaulted, or lost, but gold and silver are physical commodities.

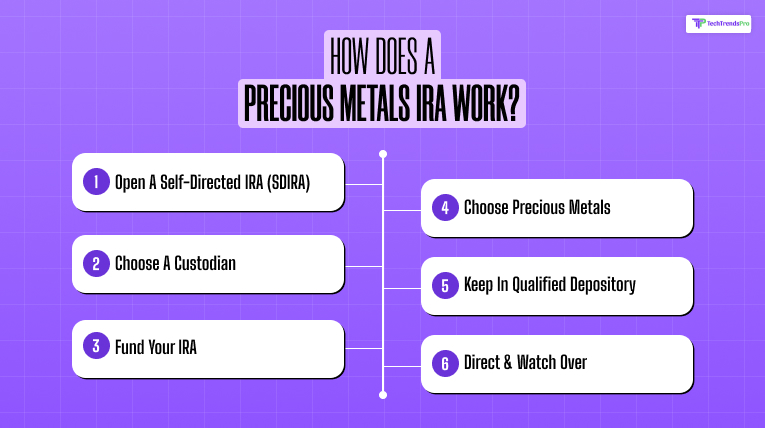

How Does A Precious Metals IRA Work?

If you wanna know how a precious metals IRA works, then here is a step-by-step process of how to know.

Step-By-Step Process:

- Open a Self-Directed IRA (SDIRA)

- Your alternative investments, such as metals, real estate, or cryptocurrency, will be in this account.

- Choose a Custodian

- IRS rule mandates your account to be custodied by an eligible IRA custodian.

- Fund Your IRA

- Roll over new money or roll over from another retirement account (e.g., 401(k), Traditional IRA).

- Choose Precious Metals

- You choose from IRS-approved bars or coins.

- Keep in a Qualified Depository

- Your metals are stored safely, not sent to your home.

- Direct & Watch Over

- Like with a traditional IRA, you monitor your performance and rebalance your position over the long term.

How Much Should I Invest In Precious Metals?

Typically, you will want to invest 5% to 15% of your retirement nest egg in precious metals, based on the amount of risk that you can or are willing to absorb and what you’re considering as far as potential growth in the markets in the future.

Too little does little to protect you; too much could cross over into overall potential for growth.

Is A Precious Metals IRA Safe?

Security Features

- Segregated Storage (your metals aren’t commingled with anyone else’s)

- Full Insurance Coverage

- Audits and Reporting by Custodians

- IRS Rules allow compliance and transparency

These protections make physical metals an ironclad investment, much safer than most people know.

What Are The Tax Benefits?

Precious Metals IRAs enjoy the same tax advantages as every IRA:

- Traditional IRA: Postpones taxation of growth; paid at withdrawal

- Roth IRA: Taxes prepaid; tax-free in retirement

Because you’ll be in the IRS’s good graces, you won’t be taxed on gold to put in your retirement account.

Are There Risks Or Downsides?

There are sacrifices that come with every investment, and Precious Metal IRAs are no different:

Possible Pitfalls:

- Storage and Custodian Fees (that can eat away at your profits)

- No Dividends or Interest on the metals

- Illiquidity (not as liquid to sell at maturity as stocks)

- Market Volatility (yes, the metal prices do fluctuate)

High net worth investors balance these against the long-term dividends of diversification and coverage.

How Has Gold Performed Historically?

A brief history of returns summary of gold:

| Period of Time | Average Annual Return |

| Last 20 Years | ~9% |

| Last 10 Years | ~3.5% |

| During 2008 Crash | +5% (while S&S declined 38%) |

Not always a high-growth asset, but a survivor one—particularly in down times.

Can You Rollover A 401(k) Into A Precious Metals IRA?

Yes, you can. It is actually not surprising that most people would finance their Precious Metals IRA through rolling over:

- Traditional IRA

- 401(k)

- 403(b)

- TSP (Thrift Savings Plan)

You must roll over in the right way so you won’t be penalized and taxed. Dial a qualified custodian.

Who Should Consider A Precious Metals IRA?

Ideal For:

- Individuals near retirement age

- Investors are concerned about inflation or currency collapse

- Anyone looking for long-term preservation of wealth

- People with volatile portfolios lacking real assets

If you’re buying gold bars to store under your mattress, a Precious Metals IRA is a smarter, IRS-approved way to do it.

How To Choose The Best Precious Metals IRA Company?

Look for:

- Experience and reputation

- Transparent pricing

- Low storage/custodian fees

- Good customer reviews

- Straightforward rollover process

Good companies will typically provide you with free guides, personal coaches, and even incentives like free silver when you open a new account.

What Are The Fees?

Fees are normally:

- Setup Fee: $50–$150

- Annual Custodian Fee: $75–$300

- Storage Fees: $100–$250/year

- Markup on Metals: Dealer variable

Always request a fee breakdown in mind-boggling detail before you open your account.

What Questions Should I Ask Before Opening An Account?

- Is my custodian IRS-approved?

- Are my metals segregated or commingled?

- Can I have physical possessions at retirement?

- What fees are there?

- How is the rollover done?

Can I Get Physical Delivery Of The Metals Someday?

Yes, at age 59½ at retirement, you can:

- Sell the metals and take cash

- Physical delivery of your bars or coins

Or maybe they just have gold scattered around the house while rolling over their IRA.

Think About Adding A Precious Metals IRA?

If you’re serious about diversifying your retirement, safeguarding your finances against inflation, and achieving long-term financial freedom, a Precious Metals IRA is certainly an option worth thinking about.

It won’t be your whole retirement portfolio—but it can be a great addition to stocks, bonds, and other investments.

Summary Checklist

| Key Benefit | Reason to Care |

| Diversification | Reduces risk of market crashes |

| Inflation Hedge | Preserves your purchasing power |

| Tangible Assets | Real, physical assets—not just paper |

| Safe Haven | Performs well when something goes wrong |

| Tax Advantages | Like a traditional or Roth IRA |

Read Also: